Paycheck Calculator Illinois 2025

Paycheck Calculator Illinois 2025 - Best European Cities To Visit In February 2025. Make 2025 the year you visit the […] Free Paycheck Calculator Salary Pay Check Calculator in USA, Just enter the wages, tax. Maximize your 401k contributions in 2025:

Best European Cities To Visit In February 2025. Make 2025 the year you visit the […]

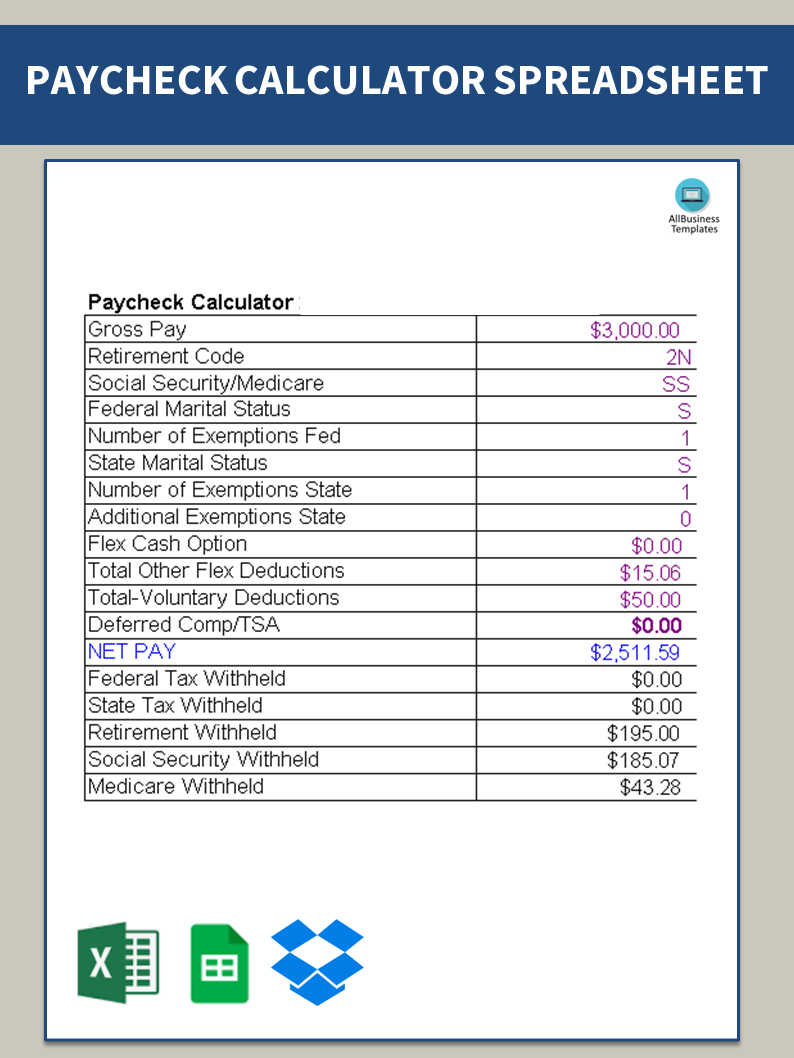

Use smartasset’s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

How Much Is Ssi In Illinois 2025 Gene Peggie, Free tool to calculate your hourly and salary income after taxes, deductions and exemptions. The rate has remained consistent over the years, for example, it was the same in 2023.

How to Calculate Payroll Taxes, Methods, Examples, & More (2025), You can use this amount to help estimate your budget and spending. It will calculate net paycheck amount that an employee will receive based on.

A guide with calculator new updates to the 2023 and 2025 401k contribution limits.

The illinois tax calculator includes tax. You can use our illinois payroll calculator to calculate all your employees’ federal withholdings, plus any additional taxes your business is responsible for paying.

The rate has remained consistent over the years, for example, it was the same in 2023.

Pay & Salary Calculators Take Home Pay after Taxes, This is the amount that actually goes into your bank account or paycheck every pay period. Calculate net payroll amount (after payroll taxes), federal withholding, including social security tax,.

About Us illinois Paycheck Calculator, The state of illinois has set the individual income tax rate for 2025 at 4.95%. 2025 payroll tax and paycheck calculator for all 50 states and us territories.

Saratoga Springs Regatta 2025. Apr 27, 2025 sprint saratoga springs, ny fish creek saratoga rowing […]

Illinois Paycheck Calculator Formula To Calculate Take Home Pay, The salary tax calculator for illinois income tax calculations. Divide the sum of all applicable taxes by the employee’s gross pay.